401k withdrawal tax calculator fidelity

Designed for Small Businesses These Solutions Feature Easy Plan Design Administration. Ad Schedule a call with a vetted certified financial advisor today.

After Tax 401 K Contributions Retirement Benefits Fidelity

A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees.

. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. Compare your matched advisors for fees specialties and more. Second many employers provide.

In this case your withdrawal is subject to the. Use the Contribution Calculator to see the. With this tool you can see how prepared you may be for retirement review.

The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place. Also you should remember that the results you. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. 401 k Withdrawal Calculator. Discover The Answers You Need Here.

401 k withdrawals are an option in certain circumstances. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment.

Of course taxes will be due when you withdraw money from your Plan. Ad Download Our Program Highlights and Show Clients the Benefits of a SIMPLE IRA Plan. Fidelity Investments - Retirement Plans Investing Brokerage Wealth.

Taxes will be withheld. Use this calculator to estimate how much in taxes you could owe if. But what long-term gains are you giving up for cash on hand now.

The IRS generally requires automatic. For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

The payroll taxes collected may not be enough to pay. May be indexed annually in 500 increments. Using this 401k early withdrawal calculator is easy.

If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis. Monthly withdrawals are estimated by calculating the hypothetical withdrawal a portfolio may support in a poor market condition.

First all contributions and earnings to your 401 k are tax-deferred. Individuals will have to pay income. Pre-tax Contribution Limits 401k 403b and 457b plans.

You only pay taxes on contributions and earnings when the money is withdrawn. Ad Explore Fidelitys Wide Range of Mutual Funds With Zero Minimum Investment. After taking out 12950 in standard deduction his first 10275 of taxable income will be taxed at 10 the remaining 31400 or ordinary income at 12 and because of his.

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For The Opt Saving For Retirement How To Plan 401k Plan

After Tax 401 K Contributions Retirement Benefits Fidelity

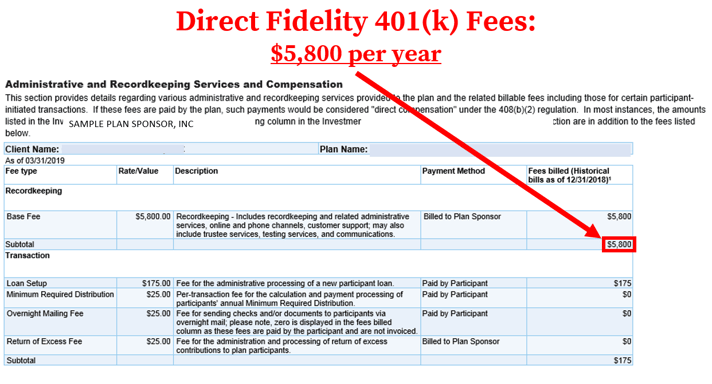

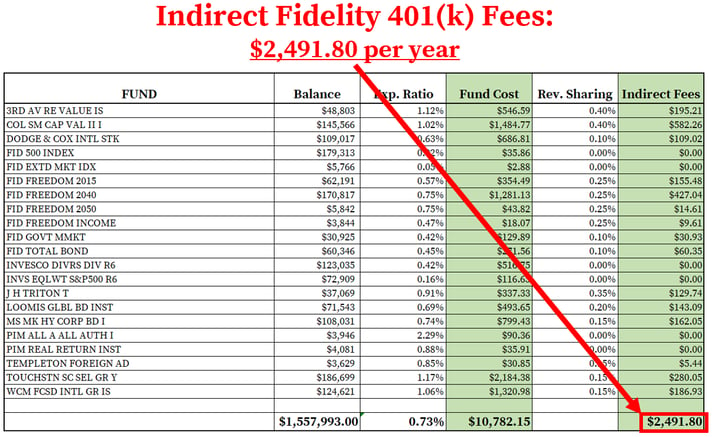

How To Find Calculate Fidelity 401 K Fees

How Do I Calculate How Much Money Is Available For A 401 K Loan

How To Find Calculate Fidelity 401 K Fees

Solo 401k Rules For Your Self Employed Retirement Plan

Can A Solo 401 K Reduce Self Employment Tax Ira Financial Group

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

401 K Plan What Is A 401 K And How Does It Work

Roth 401k Roth Vs Traditional 401k Fidelity

The Average 401 K Balance By Age Income Level Gender And Industry

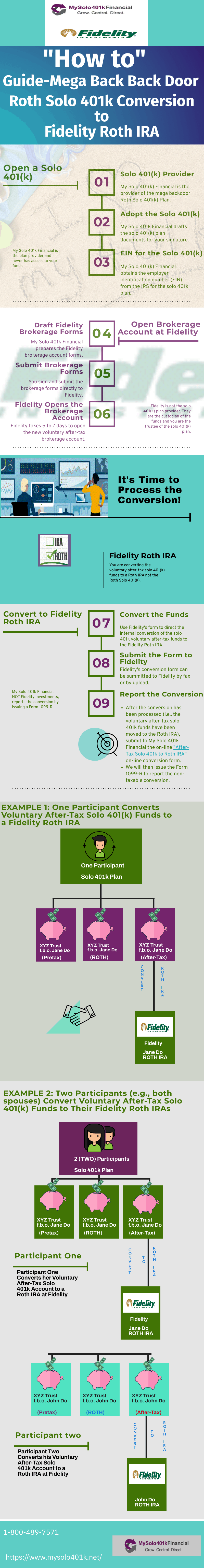

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

How To Find Calculate Fidelity 401 K Fees

What Happens When You Inherit An Ira Or 401 K

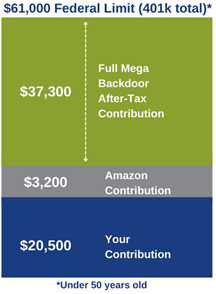

Amazon S 401k Roth Conversion Avier Wealth Advisors